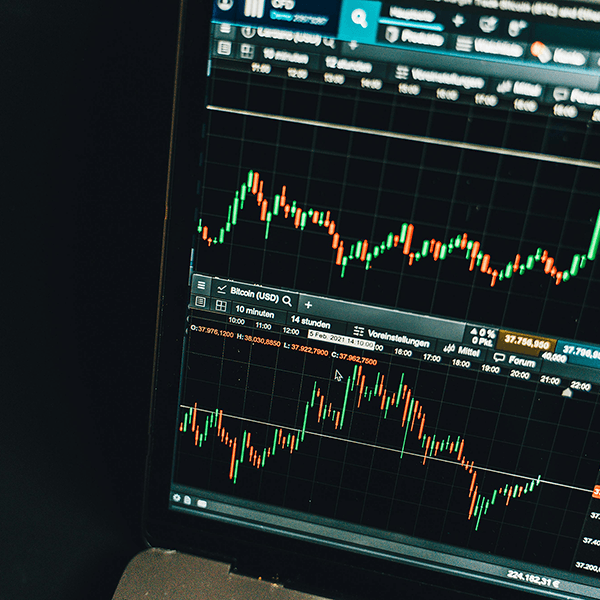

A holiday-week catch-up: light trading kept markets mostly sideways, but the average 30-year fixed edged to near two-month lows as bonds got a small lift from Europe and pending home sales improved.

Published on 12/30/2025

Inflation slowed in November after peaking earlier this fall. Here’s what that means for mortgage rates and what homebuyers should watch next.

Published on 12/18/2025

The Fed cut rates by 0.25% and ended quantitative tightening, but the real story for the average 30-year fixed is in the dot plot and Powell’s comments. Here’s what that means for mortgage rates and homebuyers.

Published on 12/10/2025

Mortgage rates bounced around but stayed in a tight range near the low 6% area this week, while purchase applications hit their highest level since early 2023 and refinance demand more than doubled compared to last year. Here’s what that means if you’re thinking about buying or refinancing.

Published on 12/06/2025

As home prices continue to rise and traditional mortgage payments stretch buyers’ monthly budgets, innovative financing strategies have become more important than ever. One program gaining significant traction—especially among self-employed borrowers, investors, and high-cost-market buyers—is the 40-year interest-only mortgage.

Published on 12/05/2025

Stronger jobless-claims and durable-goods data from last week pushed the average 30-year fixed slightly higher, but mortgage rates are still near recent lows. Here’s what that means for buyers and homeowners

Published on 12/01/2025

Mortgage rates held steady after a mixed jobs report, with unemployment rising and job growth coming in stronger than expected. Learn what this means for homebuyers and what to watch next.

Published on 11/21/2025

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

What an incredible evening! Last night’s Sunset Rooftop Yoga Event was everything we hoped it would be — a perfect blend of wellness, food, and community connection under the San Diego sky.

Published on 10/23/2025

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Published on 10/22/2025

here’s something magical about yoga at sunset — the soft light, the ocean breeze, and the feeling of collective calm as the city begins to slow down. This month, we’re bringing that magic to life with a special rooftop yoga event right here at our building.

Published on 10/16/2025

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Published on 10/15/2025

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

At Park Place Collective, we’re always looking for innovative ways to help our clients, partners, and future homeowners achieve their real estate goals with confidence. That’s why we’re excited to introduce our Permanent Mortgage Rate Buydown Program—a strategy designed to create long-term affordability and make today’s market more accessible.

Published on 09/26/2025

At Park Place Collective, our mission has always gone beyond homeownership and financial solutions—we believe in building stronger, healthier communities. That’s why we’re thrilled to share some exciting news: Joe and Marni Costa and the Park Place Collective team are now ambassadors for THE REAL Mental Health Foundation.

Published on 09/26/2025

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025