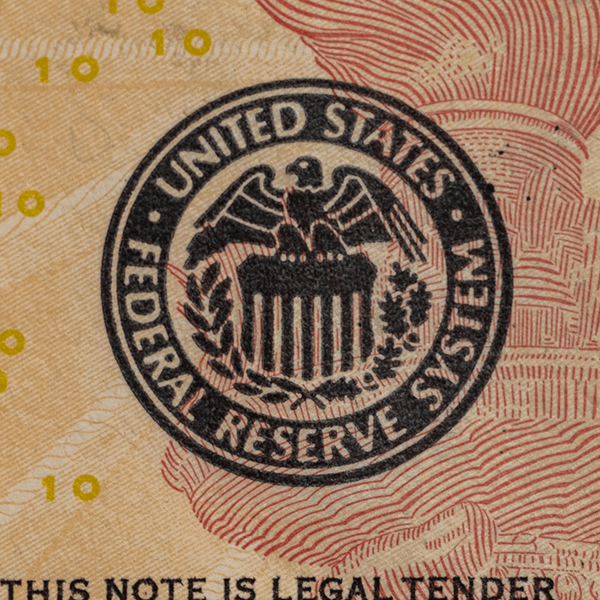

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

The Federal Reserve just announced a rate cut, lowering the federal funds target range from 4.25%–4.50% to 4.00%–4.25%. While this isn’t the mortgage rate itself, the move has an immediate and long-term impact on the housing and lending market.

Published on 09/17/2025

The Federal Housing Finance Agency (FHFA) has announced the new conforming loan limits for 2026, and they’ve once again increased, giving buyers and homeowners more flexibility and opportunity in today’s housing market.

Published on 09/17/2025

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

September 11 is a day forever etched in memory—a day that reshaped the world, our city, and our lives. For me, it was not only an event I witnessed on television, but a reality I lived through while in my office in midtown Manhattan.

Published on 09/11/2025

When: Saturday, September 13, 2025 • 9:00 AM – 12:30 PM Where: Little Italy Core Power Yoga (San Diego)

Published on 09/10/2025

At Joe Costa and Park Place Collective, we believe everyone deserves the opportunity to achieve the dream of homeownership. That’s why we’re proud to introduce the Freedom Down Payment Assistance Program (Freedom DPA)—a truly unique solution designed to remove one of the biggest barriers to buying a home: the down payment.

Published on 09/05/2025

At Park Place Collective, we understand the aviation industry like few others do. Pilots, flight attendants, ground crew, and contractors all face unique financial realities—irregular schedules, variable income, and frequent relocations. That’s why we created specialized mortgage programs designed specifically for aviation employees and contractors.

Published on 09/04/2025

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025

Mortgage rates stayed mostly flat this week, holding near 10-month lows. Here’s what happened from August 18–20 and why upcoming economic data could shake things up.

Published on 08/20/2025

Buying, selling, or refinancing a home moves fast—and the right mortgage partner should move faster. After 30+ years in the business, I’ve learned that success comes down to three things: clear guidance, creative problem-solving, and quick decisions. That’s the service standard I bring to every client and every real estate partner.

Published on 08/18/2025

If you've been waiting for the right time to buy a home, refinance, or invest in real estate, this could be the window you’ve been waiting for. After the release of early August’s jobs report and some mixed inflation data, mortgage rates have dropped to their lowest levels in nearly 10 months. But that’s just part of the story...

Published on 08/15/2025

Mortgage rates are holding near 10-month lows after early August’s jobs report and mixed inflation data. Here’s what homebuyers and homeowners need to know.

Published on 08/14/2025

Highlight and cross promoting with local community businesses

Published on 08/12/2025

At Park Place Collective, we are committed to helping individuals and families achieve their dream of homeownership. One powerful financing option that often goes overlooked is the USDA loan. Backed by the U.S. Department of Agriculture, USDA loans are designed to make buying a home in rural and eligible suburban areas more affordable and accessible for low- and moderate-income borrowers.

Published on 08/08/2025

By Joe Costa | Park Place Collective – Mortgage | Real Estate | Life Insurance Protection On August 2, 2025, the U.S. Senate passed the Homebuyers Privacy Protection Act, widely known as the Trigger Leads Bill. This landmark legislation is a major win for homebuyers, mortgage brokers, and the entire housing market, as it prioritizes consumer privacy and security during the mortgage process. What Are Trigger Leads?

Published on 08/05/2025

Mortgage rates just hit their lowest levels since October 2024 following a big shift in the bond market. Here’s why it matters for homebuyers and homeowners.

Published on 08/05/2025

Confused by the housing market? You're not alone. Here's why the market feels hot and cold at the same time—and what it means for you as a homebuyer.

Published on 07/30/2025

For years, cannabis business owners and their employees faced one major roadblock: life insurance protection. Despite building successful dispensaries, cultivation facilities, and related businesses, most owners were told “no” when they tried to secure basic coverage for themselves, their partners, or their employees. Federal restrictions kept traditional carriers from stepping in, leaving families, businesses, and key employees exposed.

Published on 07/29/2025